Overall, the best free forex trading platform is MetaTrader 4, offered through Pepperstone. This software is the highest regarded in the foreign exchange market with outstanding popularity. MetaTrader 4 is reliable and has many necessary features, such as accurate quotes and automated trading facilities. Pepperstone is the top forex broker for the MetaTrader 4 platform due to its low spreads and fast trade execution speeds.

This includes everything from currency pairs and futures to spot indices, shares, commodities, and energy. The broad array of trading instruments undoubtedly elevates the overall trading experience on cTrader. Additionally, FxPro provides top-notch training programs, up-to-date news, comprehensive research, and essential trading tools.

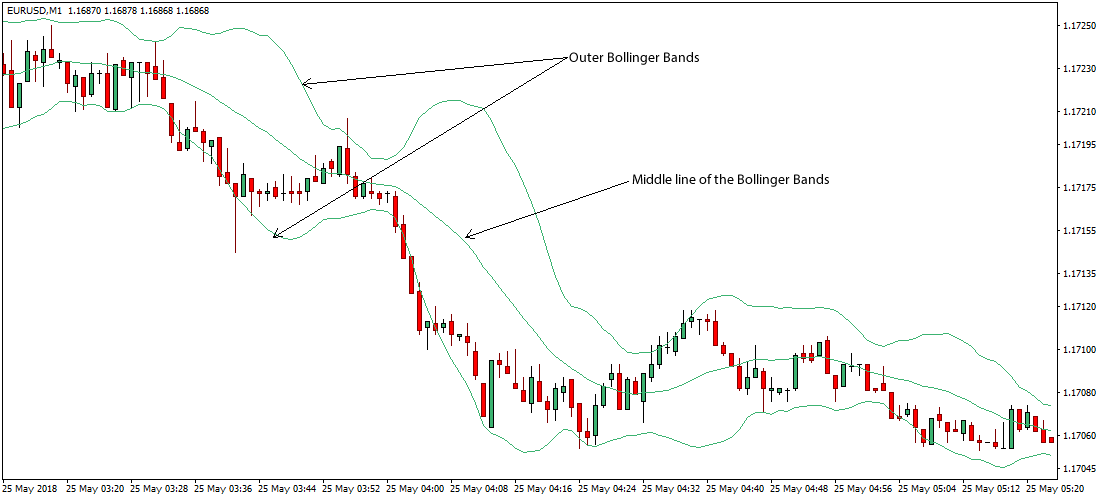

How to Use Trading Charts for Effective Analysis

But, you can’t expect to come away with the knowledge and practical experience it takes to trade with confidence. If you desire to go from absolute novice to expert Forex trader in three months, you should expect to pay more for a course—somewhere in the range of $50 to $200 a month. The real value with many of the top courses is the ongoing access through membership to trading rooms, mentors, and ongoing education. The most successful Forex traders will tell you that becoming an expert is a journey, a continuous learning process.

The ECN Institutional account is only for the most experienced traders out there, given the $20,000 minimum deposit it asks for. Custom watchlists, price alert setups, and market-specific notification configurations have been integral in tailoring our trading journey. We could also integrate the social trading platform Myfxbook with MT4, tapping into one of the world’s most extensive trading communities. We at CompareForexBrokers have created the calculator module to demonstrate the trading cost you will pay when buying forex assets between different brokers and factors in the commission plus the spread costs.

Best Forex Brokers in South Africa

Developed in 2005 by MetaQuotes, we’ve observed that over 85% of forex brokers offer MT4. Despite the release of MetaTrader 5 in 2010, more brokers offer MetaTrader 4 than any other platform, which is one factor for its popularity. Overall, IG can be summarised as a trustworthy broker that provides Contracts for Difference (CFDs)

and low spreads on 70+ trading instruments. IG is regulated by two tier-1 regulators (highest trust)

and it has a trust score of 96 out of 100. The course is self-paced, allowing students to take an individualized approach to learning.

They do that by trading derivatives, which allows them to speculate on a currency’s price movement without taking possession of the currency. Also referred to as foreign exchange or FX trading, Forex trading is how one currency is traded for another for financial advantage. Most Forex trading occurs on the spot market, more commonly known as the Forex market, where currencies are bought and sold according to the current price. The Forex market is run by a global network of banks and financial institutions.

Our account manager contacted us the same day we signed up, and was particularly useful in helping us get started. This is why we scored Pepperstone a perfect 10/10 for account opening, where we tested the account opening process of 20 brokers. Ross Collins, the head of our Forex research team, tested the average spreads for commission-based accounts for 15 brokers and found Pepperstone to be among the best. While not the overall winner (that honour went to Fusion Markets), Pepperstone is the only broker offering these same spreads globally backed with the appropriate regulation for most jurisdictions. This is because Pepperstone is regulated by the FCA in the UK, CySEC for European traders, DFSA for traders in the UAE and, of course, ASIC for Australian traders. Many forex brokers — including Forex.com and TD Ameritrade — offer paper trading tools that let you test different strategies without putting any money at stake.

CMC Markets

We believe connecting with such a vast community can be a game-changer for many traders. Trading can be expensive with commissions, spread costs, and license fees for trading platforms. Those looking for a free environment can either open an account with a prop trading firm or open a free forex platform listed below. We’ve separated each section into trading platforms and the best forex brokers that offer them. When selecting your forex broker, you should consider trading platforms and tools, the number of currency pairs offered, customer service and, of course, trading costs.

BTC/USD Forex Signal: Points to More Sell-Off – DailyForex.com

BTC/USD Forex Signal: Points to More Sell-Off.

Posted: Tue, 12 Sep 2023 18:35:23 GMT [source]

IC Markets offers excellent MT5 features, which add to its credibility as our top MT5 broker. The Signals service allows you to copy trades of other traders, while the Market provides you with various Expert Advisors and Technical indicators that you can buy. “In the forex industry, it’s crucial to approach promises of quick riches and effortless success with caution. It

may just be the best investment you ever make and you won’t even

spend a penny. For more details about the categories considered when rating brokers and our process, read our full methodology.

OUR RECOMMENDED TRADINGVIEW BROKER

The platform isn’t merely about executing trades; it’s a treasure trove of research tools, the latest news, posts, and enlightening articles. It serves as a melting pot for global insights from traders, enriching our trading journey and knowledge base. Over 250 financial instruments, including forex pairs, futures, spot indices, shares, metals, and energies, are offered by FxPro on the cTrader platform. Complementing this vast instrument selection https://1investing.in/ are FxPro’s educational modules, real-time news updates, analytical insights, and trading toolkits, all of which enhance our cTrader trading experience. Having fast execution speeds is one thing; it’s another to offer a fast account opening process, which not all online brokers deliver on. When opening an account with Pepperstone, we found the broker to offer a simple, 4-step process with our account approved in a few hours, not days.

- While CMC Markets only offers one CFD account, the broker had the second-best spreads for a no-commission account from our testing.

- Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

- Developed by Spotware, the platform is available on desktop, Web Trader, and mobile devices.

- This gives flexibility should you not wish to be locked into a broker’s ecosystem.

Forex is attractive to people looking to earn extra money from the comfort of their homes. For those who are willing and able to commit to learning the ins and outs of Forex trading, it offers several advantages, such as low capital requirements and ease of entry into the market. For people with a solid foundation of knowledge and the ability to control their emotions, it does offer the opportunity to generate income, either part-time or as a career. Forex is typically traded as a currency pair—buying one currency while simultaneously buying another. The most frequently traded pairs are the euro versus the U.S. dollar (EUR/USD) and the British pound versus the U.S. dollar. Most traders speculating on Forex prices do not take delivery of the currency but, instead, predict the direction of exchange rates to take advantage of price movements.

Forex trading in general isn’t where we’d suggest beginner investors get started — if you’re brand new to investing, check out our list of the best brokers for beginners. That said, if you’re a seasoned investor looking to dabble in trading forex for the first time, you might benefit from going with a more traditional broker to start, like TD Ameritrade, Interactive Brokers or Ally Invest. The Oanda fxTrade App is designed to be user-friendly for professional and retail traders alike. The app is secure and super-responsive with a customizable Interface, Multi-Asset product suites, one-click trading, and much more. Overall, Forex.com can be summarised as a trustworthy broker that provides Contracts for Difference (CFDs) and low spreads on 5500+ tradable symbols.

While we cannot guarantee you will be successful after

completing our course, we can say that you will be in a much

better position to start trading. Not only will you be more

prepared to make money, more importantly, but you’ll also be

less likely to lose it. When you open & fund a new account with $5K on Chase.com or the Chase Mobile® app.

MetaTrader 4, MetaTrader 5 and cTrader are among the most popular free trading platforms. While CMC Markets only offers one CFD account, the broker had the second-best spreads for a no-commission account from our testing. The quotes showcased by FxPro are closely aligned with the final order fulfilment price. In our comparative evaluation of FxPro’s platforms, we observed spreads ranging from 1.58 pips on MT4 to 1.51 pips on MT5.

For that reason, we selected FX Academy as the best free option for a Forex trading class. Additionally, for $118 per month or $1,200 per year, members can access another valuable proprietary program, the Golden Eye Group. Once in, members have access to the inner sanctum of Ezekiel’s mind through live streams of his weekly market analysis, in which he offers his explanation and interpretation of trading setups and how he makes his trades. The best MT4 broker is Pepperstone based on spreads, execution speeds and features. To trade IG’s huge range, you can open two account types – standard (spreads but no commissions) and ECN-style (spreads and commissions).

But, as the best overall Forex trading course, we believe you can’t go wrong with the highly regarded and modestly priced ForexSignals.com. Investopedia offers its own stock trading class as part of the Investopedia Academy, but to maintain objectivity, we opted to exclude it from this roundup. If you are interested in this course, please visit the Investopedia Academy. In addition to these features, cTrader has its own version of Expert Advisors called cTrader Automate (formerly cAlgo). Coders will appreciate the use of C#, a language well understood by programmers. Traders needing further help have access to resources such as cTDN forums and the cTrader Developer Network.

There is no difference between a demo trading account, trading simulator or paper trading account. All of these terms are just synonyms for the same type of simulated trading difference between durable and nondurable goods platform. It’s a well-known fact that forex trading in SA boomed during Covid, as South Africans facing financial uncertainty sought new ways to make passive income.

We found these Razor account spreads very competitive compared with other top brokers like Eightcap and IC Markets. To reinforce their learning, students have access to the Trading Room, which functions as a chat room to share ideas and showcase trading strategies. Also, students are able to follow live-streamed trading sessions of the professional traders. Membership also includes access to several proprietary trading tools, including the Profit Calculator and the Monte Carlo Simulator. Being seasoned traders, we regard CMC Markets as the most comprehensive forex broker, especially given the sheer volume of currency pairs and CFD instruments they offer.